The main difference between the Amazon Store Card and the Amazon Credit Card is that the previous must be utilized to make buys at Amazon and where Amazon Pay is acknowledged, though the last can be utilized basically anyplace on the planet. So, this prompts a second contrast, which is the endorsement necessities.

Table of Contents

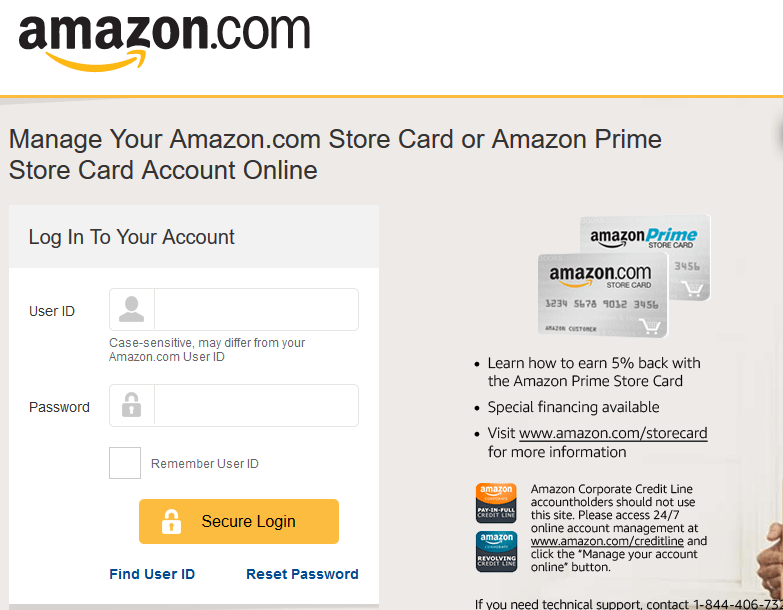

About amazon store card

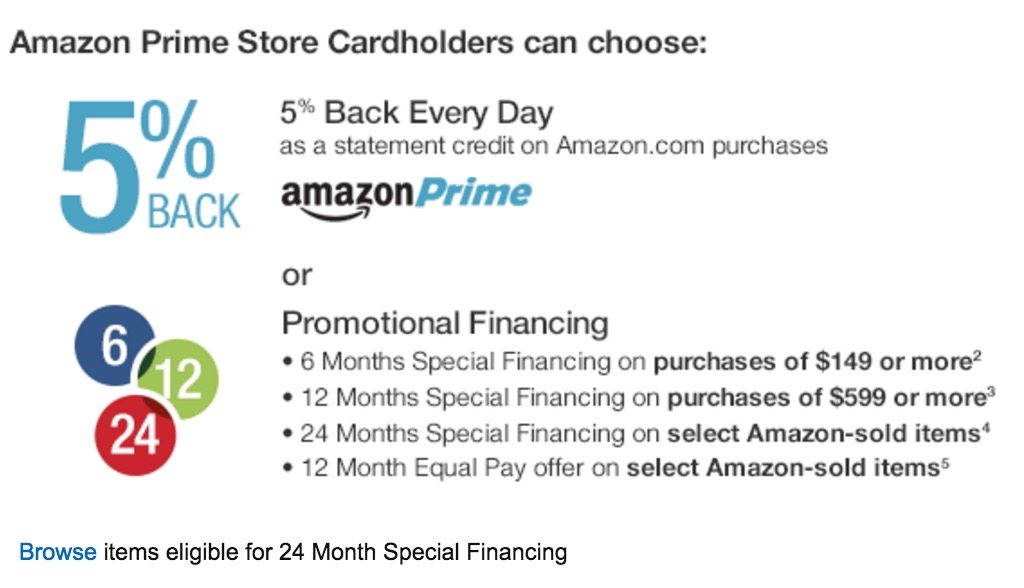

In case you’re an unwavering Amazon.com shopper, you’ve presumably at any rate considered the Amazon Store Card. Although made for Amazon Prime shoppers, this card makes it simple to win 5% back on whatever you purchase at the online superstore. On the other side, you can likewise swear off the 5% back and stretch out your installments with zero enthusiasm more than a while. But, Like most store credit cards, the Amazon store card doesn’t charge a yearly expense. Be that as it may, it’s useful for Amazon.com buys, and can’t be utilized just anyplace. In any case, with free money back and no charge, could you ask for anything better?

Like some other money related item, the overlooked details are the main problem when you take a gander at how the Amazon Store Card functions. Here’s an essential once-over of the Amazon card’s many financing options, alongside how they can enable you to spare.

Amazon store card working

With the amazon store card login, you’ll win:

- 5% back on absolute truck buys up to $149

- 5% back or half year financing on buys of $149 or more

- 5% back or year financing on buys of $599 or more

- 5% back or two year financing on select Amazon-sold things

In addition to these options, you can likewise appreciate 0% APR on explicit Amazon buys in the event that you pick to make 12 equivalent regularly scheduled installments. This can come in convenient if you intend to make a huge Amazon.com buy (seasonal shopping, possibly?), and still need to pay it off progressively without paying interest from the start. Without a doubt, you get 0% APR temporarily, but since of the manner in which intrigue is compounded and charged, you’ll be in for a severe shock if you don’t fork over the required funds when your special period is finished. If your parity doesn’t hit zero preceding the limited time frame closes, you’ll owe antedated enthusiasm on the whole buy. More awful, the Amazon Store Card comes with an APR of 26.24%!

Amazon Synchrony

However, you can make one-time or repeating installments on your Amazon.com Store Card Account by marking into your amazon synchrony Bank online record. Synchrony amazon Bank for the most part issues store credit cards, which just work at the particular retailers they’re subsidiary with. Be that as it may if your card has a Visa or MasterCard logo and a lapse date, it tends to be utilized essentially anyplace.

As it were, neglecting to pony up all required funds before the 0% financing time frame finishes implies, you’ll owe enthusiasm from the day you made the buy. However, if you know anything about credit, you definitely realize what a tremendous drawback this is. Also, extremely, this ought to likely be a major issue except if you’re 100% sure you can pony up all required funds inside the limited time course of events.

About amazon credit card

If you’re not very enthused about the best approach to intrigue accumulates with the Amazon Store Card, then you can generally consider the Amazon credit card. This card offers 3% back on Amazon.com buys, 2% back at corner stores, cafés, and medication stores, and also 1% back on every single other buy.

Another significant difference is that you don’t need to be an amazon prime part to apply. Also, similar to its store card partner, the Amazon credit card doesn’t charge a yearly expense, either. Even better, you can utilize the Amazon credit card anyplace Visa is acknowledged – and not exactly at Amazon.com.

What’s more, since it’s a conventional credit card, interest just collects on real adjusts you owe. Furthermore, the standard APR falls inside a progressively sensible scope of 14.49% to 22.49%, in view of your creditworthiness. That is not incredible, yet it’s superior to the 26.24% APR the Amazon.com Store Card offers.

As a potential drawback, you’ll just procure 3% back on Amazon.com buys rather than the 5% you would win with the store card. If you spend a great deal on Amazon.com, the difference in income could be generous.

Better option for Amazon.com Purchase

In any case, Amazon.com doesn’t have the market cornered on credit cards for their site. With Discover it® Cash Back, you get 1% boundless cash back consequently on each buy you make. The kicker is, you additionally get 5% cash back at different places each quarter like service stations, markets, eateries, Amazon.com and more up to the quarterly most extreme each time you actuate.

The Discover it® Cash Back doesn’t charge a yearly expense, which means you can keep it in interminability without paying for its advantages. Talking about advantages, this card offers your free FICO score on your month to month explanation and no remote exchange charges. You likewise get 0% APR on parity exchanges for an entire 14 months and afterward the continuous APR of 14.24% – 25.24% Variable APR. That is a truly sweet arrangement for a no-expense card that offers astonishing prizes.

Highlights

Card Highlights Provided by Discover:

- Introduction OFFER: Discover will coordinate ALL the cash back you’ve earned toward the finish of your first year, consequently. There’s no joining. What’s more, no restriction to what amount is coordinated.

- Gain 5% cash back at different places each quarter like service stations, markets, eateries, Amazon.com and more up to the quarterly most extreme, each time you enact.

- In addition, procure boundless 1% cash back on every single other buy – consequently.

- Recover cash back any sum, whenever. Rewards never terminate.

- Utilize your prizes at Amazon.com checkout.

- Get an alarm if we locate your Social Security number on any of thousands of Dark Web sites.* Activate for free.

- No yearly expense.

If you’re considering agreeing to accept the Amazon Store Card login, make a point to consider the options that are out there. While it’s actual 5 percent back is difficult to beat, different prizes credit cards are genuinely liberal with regards to Amazon.com buys, as well.